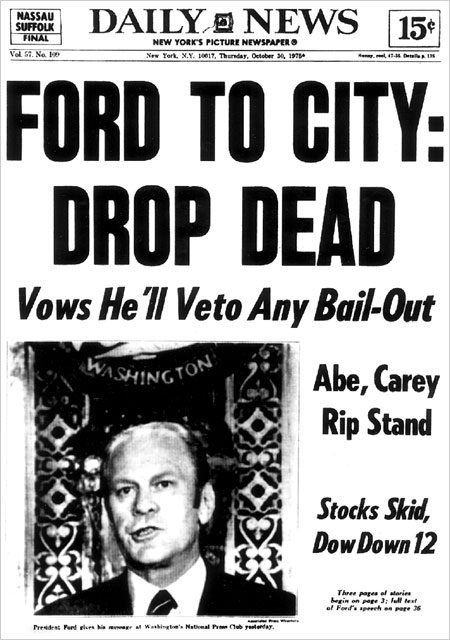

“Ford to New York: Drop Dead,” said a famous headline in 1975. President Ford had declared flatly that he would veto any bill calling for “a federal bail-out of New York City.” What he proposed instead was legislation that would make it easier for the city to go bankrupt.

Now the Federal Treasury and Federal Reserve seem to be saying this to the states, which are slated to be the first ritual victims in the battle over the budget ceiling. On May 2, Treasury Secretary Timothy Geithner said that the Treasury would stop issuing special securities that help state and local governments pay for their debt. This was to be the first in a series of “extraordinary measures” taken by the Treasury to avoid default in the event that Congress failed to raise the debt ceiling on May 16. On May 13, the Secretary said these extraordinary measures had been set in motion.

Now the Federal Treasury and Federal Reserve seem to be saying this to the states, which are slated to be the first ritual victims in the battle over the budget ceiling. On May 2, Treasury Secretary Timothy Geithner said that the Treasury would stop issuing special securities that help state and local governments pay for their debt. This was to be the first in a series of “extraordinary measures” taken by the Treasury to avoid default in the event that Congress failed to raise the debt ceiling on May 16. On May 13, the Secretary said these extraordinary measures had been set in motion.

State Bank Movement - the push for state-owned banks:

No comments:

Post a Comment